The very objective of the Sharīʿah is to promote the welfare of the people.

Wealth, security, power and material joys are all bounties given by God.

However we human beings are accountable to how we use those gifts,

Allah says in the Quran:

{And eat and drink, but be not wasteful. Certainly,

Allah does not like the wasteful extravagants!} Sura 7 verse 31

and a warning against greediness and love of the world:

{Mutual rivalry for piling up of worldly things distracts you …} Sura 102 verse 1

A New Factor In The Global Economy:

Islamic Economics

by OmarKN, M.Econ.

A.) Introduction

Islamic Economics is about generosity[fn1e], and honesty[fn1f] and helping the poor until poverty has all but vanished and helping the rich and everyone else to overcome their greediness (for ever more)[w] and their fear (of loss) and the methods to accomplish this. The believer in God and the Here-After will thus be imbued with this special kind of generosity. Islamic Economics therefore models economic life in such a way as to facilitate generosity, promote social welfare and to hinder economic egotism, greed and not the least economic fraud. Islamic Economics is intimately linked to the fact that this life is but a fleeting moment, where humans are continually tested.

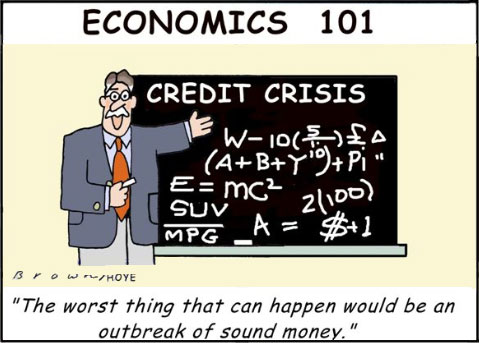

Clearly we can see that a couple of years after the worst break-down in the Western economy in 2008 - which is now the global economy, markets and economic ”players” cannot be left to themselves, without any controls. We urgently need strong market controls, especially for the financial markets. We also have to rethink the role of the increasing tendency to turn everything, even human beings into commodities, turning civic society into a market society, with 'markets' reaching into every sphere of life, down to personal relations! [fn1a] As someone observed decades ago: ”Commercialization is the notion of this civilization!” [fn1b]

We also do realize that the finance-capitalist economies - which largely form the global economy - do not ”by themselves” return to any kind of equilibrium, nor do they reform themselves in any way, at least not without dire consequences for the concerned countries. Neither did socialist economics work in the long run, nor do finance-capitalist economic theories offer a humane and equitable solution for the crisis. High time to look out for an alternative answer to the economic problem!

The question is therefore, what would be the contribution of 'Islamic economics' to economic theory and practice? [fn1d] The signs are that its contribution to standard economics will grow, sooner than later. As economist Monzer Kahf has shown, the ”Islamic point of view enriches this area of research,” because ”economics of today is [still] stamped with the Western cultural imprint," an imprint which relies on a materialistic, one-dimensional perspective.[fn1c]

In this abstract we will not focus on any historical or empirical studies[fn2] of the implementation or evolvement of Islamic economics.[fn3] And we would like to remind the reader that not all historical practice of Muslims (not even today) has always been compatible with the Islamic principles and we will not focus on the many ways of implementing those rules in different countries. Also we will not deal with the question of institutions (banks) responsible for creating credit. [fn4]

What we describe here is ‘normative economics’. This is about what people ought to do, which is most of Islamic economics, i.e. the objectives, goals (of the individual and) of the society. It is not ‘positive economics’: what people do, although evidently ‘positive economics’ is influenced by value judgements.

We shall focus in this short essay on the basic Islamic rules for economic interchange, which are stipulated in the Divine Law (Sharīʿah). However the use of the prefix ‘Islamic’ does not mean that, ”this science (is) restricted to Islamic societies or to Muslims.” [fn5]

The name ‘Islamic’ is to identify and clarify our bias. Every (scientific) theory has implicit value judgments. We don’t deny our bias, which is rooted in the conviction, that the Islamic rules [fn6] for economic engagement are positive and successful for the welfare (of individuals, as well as economic units, and countries), in this life and the Hereafter. This is because Islamic economics has a lot to do with trust, transparency and stability, whereas materialism and individual egotism has to do with greed, avarice and cheating. So ”economics must not be distanced [or separated] from ethics.” [fn7]

”Islamic economics seeks to enforce Islamic regulations not only on personal issues, but to implement broader economic goals and policies of an Islamic society, based on uplifting the deprived masses. It was founded on free and unhindered circulation of wealth so as to handsomely reach even the lowest echelons of society.”[fn8] To safeguard people's wealth is in any case one of the objectives of the Sharīʿah (maqāsid - مقاصد), the others are safeguarding their religion (faith), their intellect and their posterity. [fn17d]

B.) The Contribution Of Islamic Economics

As we understand it, Islamic economics is not only for Muslims or Muslim societies - i.e. 'their' economic system of Islam and its implementation, but should be seen as a universal and more equitable alternative than the dominant global interest-based economic system. This is also the conviction of Muslim economists such as Monzer Kahf. [fn9]

The main assumption of the Capitalist “free market” system - which in reality is not free at all, quite the opposite - is based on the idea that an economy will reach a balanced state and its best performance [fn10], if the economic units (individuals, companies and institutions) are allowed to pursue their own self interest, regardless of the interest of fellow man or of society as a whole. [fn11] ‘The less regulation of 'market forces', especially of banks and financial units, the better’, which was the credo of the ruling classes of the West, especially in the last 20 - 30 years of the 20th century. No wonder that without checks and balances, the worst economic crisis since the 1930ies was in the making!

In contrast, for Islamic Economics it is a matter of course that self interest has to be limited and counterbalanced by social interest, for its main goals are not maximizing individual profits, but brotherhood and justice in society. These are therefore goals towards which to strive - not as a utopia in this world, which can be 100% realized - but as a general direction towards which to advance. Those aims of brotherhood and justice are based on an awareness of a higher rationality (a spirituality), which can only be evoked by God-conciousness and accountability before God. [fn12]

Islamic Economics has its roots in the Divine Revelation, where we are told that God authorized man ”to use all resources for the construction and well-being (prosperity) of humankind.” And these ”resources are to be used in accordance with the principles of justice, human equality (advancing equal opportunities) and amelioration of life,”[fn13] neither for wasteful consumption, nor to satisfy the greediness of a few.

This is the way of the Shari’ah, which all Prophets (peace upon them) exemplified.

Islamic Economics offers therefore a wider and more importantly a more realistic perspective of the human condition, than what is possible to achieve through capitalistic economics, which is based on rational reflection alone. Islamic Economics does not assume any ideal, perfect situation or perfect decisions by people for the economy to function properly, instead it derives its strength from the reality of what is and what can be done.

So for example in case of the poor-due - zakāh - it does not propose some distant ideal, such as when zakāh is thought to be ”functioning properly”, but it just demands its implementation in any community, small or large, at any time, according to its legal (fiqhi) rules, and the ensueing process will have its positive effects, inshah Allah. [see below: zakāh]

C.) 3 Main Concepts Of Islamic Economics

The Quran and Sunna have many statements of behavioral norms and policy guidance: For example the Quranic verse 3:10 (on ribāh) or the prophetic hadith: ”Zakāh is not lawful to (be paid to) a rich person nor to a sound and capable one,” because they should be able enough to provide for themselves.

There are also statements in Quran and hadith-literature that describe human behavior without giving immediate prescriptions as how to deal with it in an economic policy, for example with regard to accumulation of wealth and the pursuit of pleasure in the prophetic tradition: ”If a son of Adam has two valleys of gold, he would seek to get a third valley, and nothing fills the inner of sons of Adam except soil.” (Bukhari and Muslim).[fn14] These are guidelines, which inform economic decisions, in this case to disallow greed and personal enrichment at the expense of everyone else.

Zakāh, Ribāh and Ihsān

1.) Zakāh - The Defence Of The Poor

Zakāh literally means ”purification (tahārah), growth, and blessing (and it) is the financial obligation of a Muslim to pay out of his net worth or agricultural output, if these are higher than the threshold of zakāt (nisāb), a specified portion as an indispensable part of his religious duties.” [fn15]

{ Successful indeed are the believers, … who are payers of the poor-due (zakāh) …} 23:1–4

The individual person is 100% responsible to pay this tax (zakāh), because ”on its conscientious payment depends … the acceptance of (his) prayers by God and (his) well-being in the Hereafter.” [fn16] This is so important, because zakāh is one of the five pillars of Islam. It has to be paid, regardless of social control or not, as ”the avoidance of zakāh cannot remain undetected … ”[fn17c] … by the One who is the Hearing and Seeing of everything.

Poverty, discrimination and ignorance restrict growth, they obviously don't advance public interest (maslaha - مصلحة). However, recent economics studies have shown that societies succeed better economically and with greater social cohesion, if they reduce inequality, i.e. those great differences in income levels between the rich and the poor. This does not mean the total elimination of income-differences, which is the socialist, materialistic utopia. The overall performance of the economy will improve in many respects: better education for all will lead to a better trained workforce, which in turn leads to a higher standard of living, in turn increasing the internal demand, etc. If tied to a greater awareness of God and the transcient character of this world, this process will even lead to a higher engagement of the whole populace in the building of the common good.

One aspect of the common good (استصلاح - seeking the best public interest) [fn17d] is to ”satisfy the needs of all those who are unable to help themselves because of some inability over which they have no control,” [fn17] which in the Muslim society is a collective obligation of since the beginning of Islam. For the ”elimination of economic exploitation of the weak by the strong is (part of) Islamic social justice.” [fn17b]

On zakāh payment in paper-money, gold, or other see below.

2.) Ribāh - vs. The Garantee For A Healthy, Balanced Economy

Ribāh has been defined as “an increment, which, in an exchange or sale of a commodity, accumulates to the owner or lender without giving in return an equivalent countervalue or recompense to the other party.” [fn18]

But ribāh was ”not only charged on money loans but was also charged on exchange of commodities in barter transactions.” [fn18b] In the Western economies have investment bankers now-a-days gone way beyond mere interest plans, instead they have invented a myriad of toxic credit schemes, which have eventually turned the big banks more powerful than the respective national states and their elected leaders, reveling in what is essentially illegal money.[fn18c]

Allah says in the Holy Quran:

{And whatever you give for interest to increase within the wealth of people will not increase with Allah. But what you give in zakah, desiring the countenance of Allah - those are the multipliers.} 30:39, So ribāh, or increase on other people’s property, really does not make some-one richer, but it is a loss for all involved and unnatural as for already the Ancients (with Aristotle) observed 2000 years ago.

However ”the concept of ribāh [in Islam is broader than with Aristotle, since it] covers not only increment (ziyadah) of the moneylender’s capital, but also increases created in speculative sales of commodities and in usurious commercial transactions and many agricultural practices.” [fn19]

Concerning those who have faith and adhere to the teachings of Islam, Allah says:

{Certainly will the believers have succeeded, they who are during their prayer humbly submissive, and they who turn away from ill speech, and they who are observant of zakah} 23:1-4 (see above on zakāh)

These two (and other) verses associate economic behavior with the doctrine of accountability before God on the Day of Judgement, [fn13b] as an example of the Islamic unity of the material and spiritual aspects of life.

Paper-money, although today a globally accepted means of exchange,[fn13f] was not the currency in Muslim lands, where gold was used as the standard of value in (all) transactions. [fn13e] Paper-money adds another complicating aspect to the case of credit and interest, because of its dubious nature: what do people actually own when they have their hands on paper-money? However this does not mean that zakāh cannot be paid in any local paper currency, as this is ”an agreed-upon fatwa in the Muslim world borrowed from the Hanafi and Maliki Madhhabs,” and zakāh on gold is better if paid in gold. [fn13d]

As mentioned above, _every excess_ charged on one party of the economic exchange (without equivalent return) is ribāh, and this is most obvious while trading in money, i.e. credit - interest. But it is equally forbidden for more hidden excesses ”in speculative sales of commodities and in usurious commercial transactions.”[fn19b] This prohibition is of course based on the fundamental principle of honesty (see ch.3) from which stems the rule of trust and transparency. Difficult or opaque schemes with hidden implications for the other part are equally disallowed as are breaches of trust in the economic exchange.

Concerning the effects of credit in an economy based on paper-money, of which practically all economies world-wide are affected these days, there has been done some research — although ignored by main-stream economics. Paper-money and the vast expansion of credit (especially when tied to interest - ribāh - as today) in its different forms of 'options', 'futures', and 'derivatives', to name a few, is neither natural, nor desired, as it impoverishes the masses of the people. It is more like a rather modern disease which began with the introduction of paper-money. [fn20] Ribāh (interest) is not 'natural' because it is based on the satanic premise of 'earning without working', as if money could 'grow'!

3.) The Third Concept: Ihsān - The Essential Condition Of Honesty And Sincerity

This is often omitted, although it is the most important!

It has to do with the individual being mindful of his (or her) accountability before God here in this life and later on the Day of Judgement. It is about the person being always aware that he (or she) is under the constant supervision of Almighty God, that he cannot hide his - good or bad - actions from Him, so its is no idea to conceal anything from Him!

The principle is that you act as if you see you Lord, and although you don’t see Him [now], He sees you!

This is based on the teaching of Prophet Muhammad (saws) when he was asked about Ihsān (spiritual excellence), and he said: ”[Ihsān is] to worship God as though you see Him, and if you cannot see Him, then indeed He sees you.” [fn21]

This is the foundation of Islamic economics system, which demands at first: Honesty in all dealings, including in business:

Allah says in the Holy Quran:

{Woe to those who give less [than due] (the defrauders,} Quran 83:1

and

{Give full measure and do not be of those who cause loss.

And weigh with an even balance.

And do not deprive people of their due and do not commit abuse on earth, spreading corruption.} Quran 26:181–183

Therefore the best economic interchange possible are those which are based on the permanent and eternal principles - those done with the above-mentioned awareness of Allah - God. From this follows in this world that economic interchanges have to satisfy both sides, the buyer and the seller, the investor or creditor and the debtor.[fn13a]

D - Further Points:

D1. Needs, Desires, Scarcity

The economic problem is about: needs, desires and available resources, it has the basic question to answer of what to produce, how and for whom. [fn13c]

Already the Holy Quran cites scarcity in economics:

{ And there is not a thing but that with Us are its depositories,

and We do not send it down except according to a known measure. } Quran 15:21, also 54:49

Although man is always reminded that in principle sufficient sustenance is provided by God; (Quran 11:6, 29:60)

this combination of scarcity and sufficiency is essential to the Islamic concept of the problem of economics. [fn14b]

If resources at a given point of time are little, then man has to use his or her talents to expand the resources, search for new ones, satisfy more wants and needs, increase the productivity of the resources.

Free goods - which are without cost, are even more important than economics goods. [fn13]

Islam is a way of life, calling on humans to behave according to revelation and to organize accordingly their interrelations as well as their relationships with non-believers.

D2. Various Topics And Challenges

- Implementation in a mixed economy

- Are control mechanisms necessary?

- Examples of historical or empirical studies of Islamic economies

- Study of the implementation or evolvement of Islamic economics

- Research on institutions (banks) responsible for creating credit

fn1e Generosity will be easy, when one reminds oneself, that in the ”Islamic perspective, all wealth belongs to God and man is only a trustee. (Allah) says, { To Him (God) belongs that is in the heavens and all that is on the earth, and all that is between them, and all that is under the soil.} (And further in the Quran, Allah says) { … and give them something out of the wealth that God has bestowed upon you.} Quran 24:33. This means that it is God who owns the wealth and that wealth has been bestowed by Him.”

→ - expired link (before 2017) - Man's Right to Wealth-INCEIF

fn1f ”Islam attaches great importance to the fulfilment of contract and promises. Islamic teachings require a Muslim trader to keep up his trusts, promises and contracts. The basic principles of truth, honesty, integrity and trust are involved in all business dealings. The Holy Quran emphasizes the moral obligation to fulfil one's contracts and undertakings. A verse states thus:

{O you who believe! Fulfil [your] obligations.} Quran 5:1

A tradition of the Prophet ( sallAllahu ʿsaleihi wa sallam ) states thus:

”The Muslims are bound by their stipulations.” Abu Da’ud, No: 3120

→ !xxx broken link! An Islamic Approach to Business Ethics; by Dr Sabahuddin Azmi

And:

An example of honesty and fair dealing in the business world: →GraceKennedy - not tested by us!

For a striking example of the opposite of honesty and fair dealing: →[fn18c]

fn1a Michael Sandel;

In an interview at amazon.com he is talking about the shift from ”having” a market economy to ”becoming” a market society, where almost everything is up for sale. The past three decades (since the 1980ies) describe the ”rise of market triumpfalism,” i.e. ”the faith that markets are the primary instruments for achieving the publing good.” After the cold war ”we fell into the assumption that capitalism is only one thing, and that it has to do with using markets everywhere. I think this was a mistake.”

And ”what happened is that market values and market reasoning now have seeped in spheres of life, traditionally goverened by other values.” So ”markets not only govern the exchange of material goods, but also personal relations, family life, education, health, (etc.) the way we think about civic life.”

”And it is in those areas where we need to have a public debate [to decide] ”where markets belong and where they might erode important values.” or ”the role and reach of markets.” The recession (financial crisis) of 2008 ”marked the end of this period of unquestioned faith that markets can solve every social and human problem.”

”We are still groping to figure this out,” i.e. the detachment of markets and morals, how to reconnect them.

Sourche interview with Michael Sandel at amazon.com, concerning his book ”What money can't buy.”

Well, it seems he should take a detached, deep look at Islamic Economics for solving this problem.

fn1b Commercialization: The act of commercializing something; involving something in commerce; ”my father considered the commercialization of Christmas to be a sacrilege”

→The Free Dictionary

And:

”Commercialism has been advancing nearly unnoticed by most consumers even since Babylonian times. …

And:

”The former Archbishop of Canterbury … once described consumerism as the new religion of the 21st century, with malls being its cathedrals. … We do not have to worship ‘gods’ carved out of wood and stone, as they did in (earlier times) for the central focus of our lives to be other than God.” in Emel editorial:

→Cathedrals of Consumerism

fn1c Monzer Kahf p.13; Relevance, Definition And Methology of Islamic Economics.(see below)

fn1d There are of course those who allege there is no such thing as ‘Islamic economics’, they are the same who deny most other obvious facts. If they were pointing at the debatable validity of such phenomenon as ”Islamic Banking,” they may even have a point in case.

fn2 A look into the history of the Muslim peoples from the inception of the first community of Madina until the onslaught of colonialism, and until the neo-imperialist intrusion in our days would certainly shed some light on this issue.

And we would like to remind the reader that not all historical practice of Muslims (not even today) has always been compatible with the Islamic principles and we will not focus on the many ways of implementing those rules in different countries.

fn3 Suffice for now to mention the anecdotical evidence given by Ottoman Muslims when describing the reason for the decline of the Ottoman economy: there was a breakdown of their tax collection system, they had bad government and inflation, among other factors. Andrina Stiles, The Ottoman Empire 1450–1700, pp. 118–126

fn4 - expired link (before 2023-02-04) monzer.kahf.com, Principles of Islamic Financing: A Survey

fn5 Monzer Kahf p.28

fn6 Rules for economic engagement: according to the Divine teachings of Islam.

fn7 IEC139

fn8 wikipedia

fn9 Monzer Kahf, p.30

While approaching the phenomenon of human (economic) behavior, M. Kahf observes that ”the Quran and Sunnah contribute much to the understanding of human behavior on a universal level.”

This universality is also found with Ibn Khaldun, who emphasized as his goal to discover ”the nature of human (civilization and) socialization as it applies to all human beings,” and not just for one part of humanity.

fn10 Balanced state and best performance: ”An economy may be said to have attained optimum efficiency if it has been able to employ the total potential of available human and material resources in such a way that the maximum feasible quantity of need-satisfying goods and services is produced with a reasonable degree of economic stability and a sustained rate of future growth.” IEC3

fn11 Adam Smith: invisible hand - laissez faire, everyone’s self-interest.

Recent research into the evolvement of his economic theory has discovered, that even Adam Smith had some definite ideas about market regulation, so that the idea of the ”invisible hand” does not negate regulatory measures by a controlling institution.

fn12 see IEC217–220

fn13 quoted from Monzer Kahf.

Note also that Allah has appointed man to be a steward on this earth, Su 2-30; and

as khalifa on earth, he must fulfill that trust placed on him by acting justly and in accordance with Allah's laws, or be false to that trust and perpetuate tyranny and injustice against Allah's earth and His creation. Su 6-165

→123muslim.com ! xx was formerly on this site -

fn14 Monzer Kahf p.7

fn15 IEC271

fn16 IEC272

fn17 IEC271 This is a simple, straight forward model for social justice, without class-struggle and without a large and expensive bureaucracy. This goes against statism!

fn17b ”Other means of human exploitation such as bribery, gambling, speculative transactions, fraudulent practices, prostitution, embezzlement, etc. have also been prohibited in Islamic society.”

→Economic System (Islam), Elimination of Exploitation, Dr. Muhammad Sharif Chaudhry

And concerning the treatment and status of women:

”Islam restored their human status and gave them equal social and economic rights along with men. (These include) rights to own (and) to acquire property and to dispose it off at their discretion. They are given rights of inheritance from their parents, their husbands, their children and near relatives. They are allowed to work to earn their livelihood through any dignified profession or vocation of their choice.”

→Economic System (Islam), Elimination of Exploitation, Dr. Muhammad Sharif Chaudhry

fn17c IEC272

fn17d ”Istislah calls good whatever is connected to one of five 'basic goods'. Al-Ghazali abstracted these 'basic goods' from the legal precepts in the Quran and Sunnah: they are religion, life, reason, lineage and property. Some add also 'honour'.”

→wikipedia: Istislah

and

”The very objective of the Sharīʿah (maqāsid - مقاصد) is to promote the welfare of the people, which lies in safeguarding their religion (faith), their intellect, their posterity and their wealth. Whatever ensures the safeguarding of these five serves public interest and is desirable.” IEC1

fn18 Al-Mabsut, vol. 7, pg. 109; quoted in IEC

fn18b ”Islam has strictly prohibited ribāh (usury or interest) to its followers, (it) decreases one’s wealth whereas Zakat increases it. Charging of ribāh in the sight of the Quran is tantamount to declaring war against Allah … During the times of the Prophet, ( sallAllahu `aleihi wa sallam ) ribāh was not only charged on money loans but was also charged on exchange of commodities in barter transactions. So the Prophet ( sallAllahu `aleihi wa sallam ) prohibited ribāh in both the forms.”

→ Economic System (Islam), Prohibited means of earning, Interest (Riba)

In the beginning of Islam there were several incidents which inform us about the profound meaning of ribāh and how to avoid it, one was the following: Abu Sayeed reported that Bilal came to the Holy Prophet ( sallAllahu `aleihi wa sallam ) with Barni dates. The Prophet asked him: From where is this? Bilal replied: There were old dates with me and I sold out for them two sa’as for one. He said: Alas! Veritable interest! Don't do (it), but when you intend to purchase, sell the dates for purchasing another kind, and then purchase therewith! (Bukhari, Muslim)

These are but a few textual proofs against ribāh, more here:

→ Economic System (Islam), Prohibited means of earning, Interest (Riba)

fn18c ”We know that the big banks conspired to manipulate Libor rates, with the approval of government authorities. … The banks have made outrageous profits by capitalizing on their own misdeeds. They have already been paid several times over: first with taxpayer bailout money; then with nearly free loans from the Fed; then with fees, penalties and exaggerated losses imposed on municipalities and other counterparties under the interest rate swaps themselves.”

xL =broken link 2020-10-01: The Big Losers in the Libor Rate Manipulation (From July 3, 2012)

fn13b Monzer Kahf

fn19 Riba & Investing in Shares, M. Afifi al-Akiti

fn13d Dr. G F Haddad, quoting this fatwa, in a review of Umar Vadillo’s ”The Esoteric Deviation in Islam”.

fn13f An Islamically correct and valid exchange is occurring when both buyer and seller exchange something of equal value, with a price for the product or service that is deemed as justified by both. This is not the case for ribāh where one part is in a situation of constraint or dire need (while not being aware of its reality). Although the use of paper-money originated with the kuffár (disbelievers), it has now become the dominant way of exchange also among the Muslims. There are no scriptural proofs which forbid paper-money, and it is anow n accepted custom (`urf) and part of the Sharī`ah.

(Paper-money is accepted by people through custom - it is not forced upon anyone and it exists even if not everyone can simultaneously claim their money from the bank, and obviously it can be owned.)

fn13e An Example Of A Commercial Agreement

→ Gold as Currency; Mamma Haidara Commemorative Library, Timbuktu, Mali

fn19b see fn19

fn20 The Origins of Paper-Money, False Growth in the Credit-Based Economy: A Historical Sketch, Aisha Bewley

fn13a In the teaching of Islam which is based on the Quran and Sunnah, in case of financial difficulties ”an insolvent person was deemed to be allowed time to be able to pay out his debt.” Allah says: {And if someone is in hardship, then let there be postponement until a time of ease. But if you give from your right as charity, then it is better for you, if you only knew.} Quran Sura Al-Baqara (2), verse 280

→ wikipedia: Bankruptcy; Creditor Debtor Rights

fn21 Famous tradition of Prophet Muhammad (saws). Al-Bukhari and Al-Muslim. What is Ihsan

fn13c Monzer Kahf

fn14b Monzer Kahf p.7

References:

IEC: Islam And The Economic Challege, M. Umer Chapra; The Islamic Foundation, UK 2003

Monzer Kahf, Relevance, Definition And Methology of Islamic Economics.

http://monzer.kahf.com/papers/english/methodology_malaysia.pdf

An edited version:

http://www.onislam.net/english/reading-islam/research-studies/politics-and-economics/454343-islam-and-economics.html?Economics=

Another edition:

http://monzer.kahf.com/papers/english/paper_of_methdology.pdf

Related texts: